Teva Announces New Environmental, Social and Governance (ESG) Strategy and Goals in 2020 Report | Business Wire

Credit Trends: Downgrade Potential Rises To All-Time High On Sharp, Deep Economic Slowdown | S&P Global Ratings

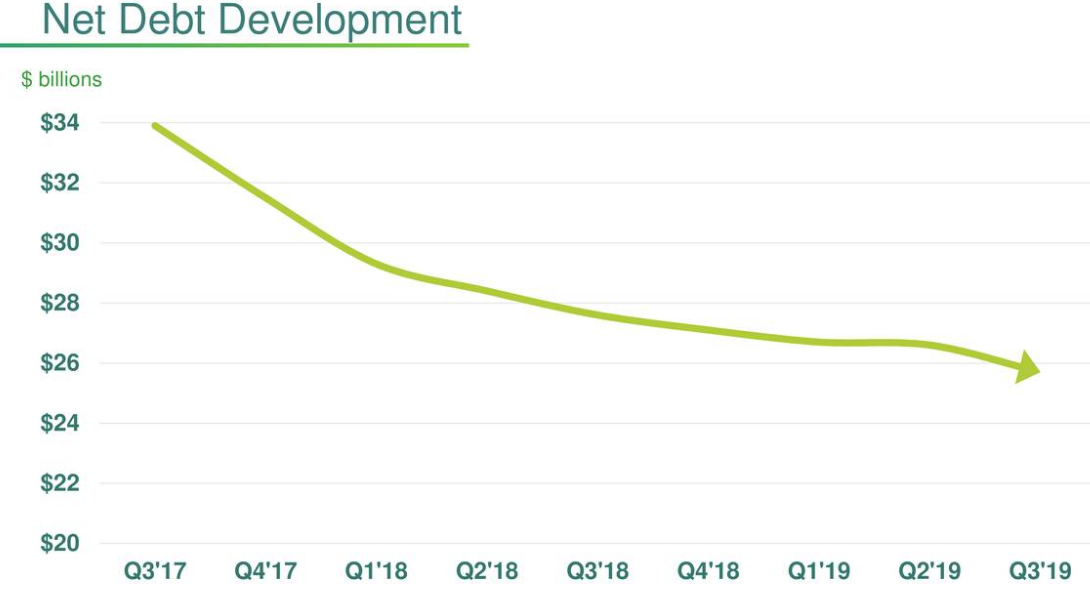

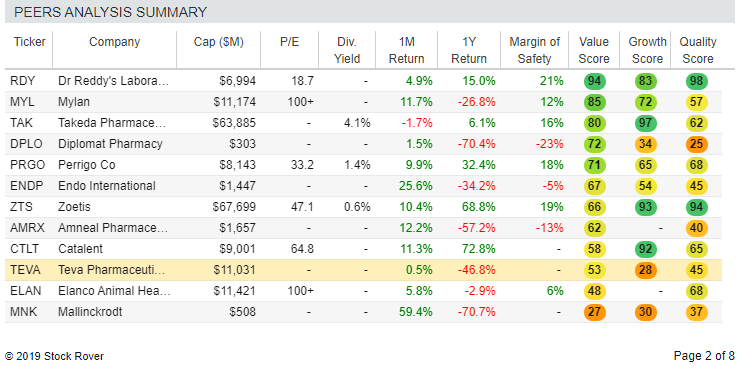

Teva May Have to Make Difficult Capital Allocation Decisions Under Pressure From Potential Generic Competition, Deleveraging Goals - Reorg

/TEVA-Chart-02142019-5c65830bc9e77c0001d93394.png)